Like I said, internet bill is not dedicated to node - it covers complete consumption of my family. In fact, node pays for internet and 70% of electricity consumed in my house.

Of course, direct trading on DEX brings much more, than leasing does, but still.

My point is - if node takes even 0.1% from leasers, it should compensate this robbery somehow. By providing additional services, paying in some valuable tokens etc

Only one question: You have a node in your home?

Yes. In the beginning I had instance rented for some 6 euro, but then found much cheaper solution

Which you prove my point with, only fan-boys see a reason to run waves nodes with 100% payouts.

So soon we don’t have this, even non fan boys can start nodes and slowly join the ecosystem and grow.

When I had my node, I didn’t had any waves back in the day, a few years ago. But it seemed cool, be able to join a crypto project without need to have money ( I was a poor student back then). So I tried it, I hanged around, and slowly started accumulating waves.

Even if only 1/10 nodes do this after they join waves-mining without waves, you already profit. Even if it just brings 1 more node, or 1 more long-term investor/interested person you win.

With 100% pay-outs you cut out that chance

A waves node shouldn’t really been run on home servers etc.

You most likely have lot’s of single point of failures.

Likely lot’s of possible downtimes, internet provider, power provider, …

A datacenter normally doesn’t have these weak spots and thus for a strong and healthy network, it’s preferable to run in a datacenter.

My point is - if node takes even 0.1% from leasers, it should compensate this robbery somehow.

Robbery? Nodes are offering a service, which obviously has its price. I got no idea how people still believe altruism has its place in securing a network.

And who lose with this break point? Lessors in node, but, who cares.

The whole network loses when nodes are dropping regulary from the system

Back to topic: We understand the concerns about security for people leasing from cold storage. It would be good to give these an advise to renew their lease in a random amount of time, so a potential attacker wouldn’t know exact.

Another idea were to list nodes and ratings about them in DEX apps and implement an easy way to randomly distribute a lease to many nodes.

This should be put in to an update and reset most forgotten leases from inactive wallets from years ago

Allow waves keeper or the new signing system to work with ledger, trezor etc maybe a solution

We from WFN think that WEP-6 is about to come back for public discussion and some reasons why:

- Remove dead wallets from staking

- Punish nodes that already go in shadows but still mine waves from dead wallets

- Make nodes owners active in eco and avoid future cheats vs stakers

- Make stakers start to care for their Weves

- Voting power needs to get out from shadows nodes

Acording to last data calculating from Isgeny there is about 3M dead waves in active nodes and shadows ones

Just curious, how he found out they are dead wallets?

Based on they staking height for each stake tx. Maybe not all 3M waves are dead wallets but lets see together

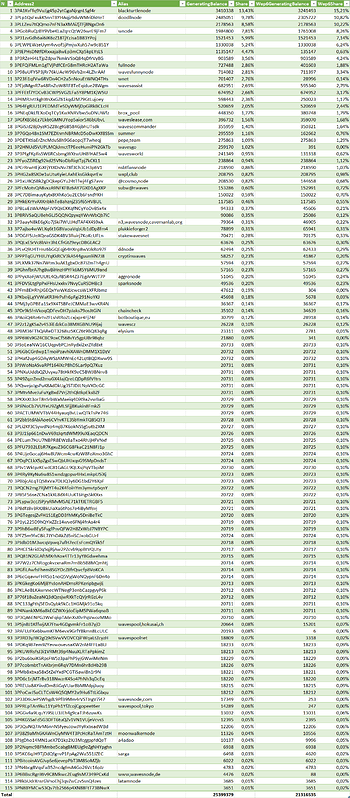

I wasn’t looking for dead wallets, just retrived active stakes from each mining nodes and applied the math from the original proposal. And Galka provided the data actual on 21 Jan 2023, here is the data for today (21 March 2023) with “share” columns for better understanding of distribution

Yeah, lets to this. I Support the idea.

@Isgeny @WavesFunnyNode thanks for sharing the data.

I’ve checked some leases which were supposed to be cancelled under WEP-6. I don’t think all of the senders can be considered inactive.

-

3PJEPHsDNtfDRxxaja8wEp3mCXp5kpLYsLS: 1M incoming from3PF82kxPdVyVA3bXSGNzhPis5ioq5K5TE4kat height 1727985, the sender also has more recent leases to the same address. -

3P23fi1qfVw6RVDn4CH2a5nNouEtWNQ4THs: 552,049.93 incoming from3PB3sfWXP2pKxqSFCfjWmemxZPGQ41a6ytg, the address is actively trading -

3PEFQiFMLm1gTVjPdfCErG8mTHRcH2ATaWa: 200,000 incoming from3PN5yFFNiDLkJphTDRNpFhibdcgCHNdH35B, which has outgoing transactions in April, 2022 (e.g. 4BH1FdTRPhTNG1pvXV6uLU9mUhy85NVgSjGKf9HZ7VVj) -

3P4MRJvttkghWsXxGZ61kqd2M79GtLujoey:

- 121,800.72008421 incoming from

3PDBi5h9KCtnvuQf9GfxFVh26X6HUEkbL17, last outgoing transfer on March, 15th (7umpKDmZ3rJe27wjkNKUNXwrarHaTJQWSsADVnRtedvo) - 101,600 incoming from

3PN5yFFNiDLkJphTDRNpFhibdcgCHNdH35B(see above)

-

3PA1KvFfq9VuJjg45p2ytGgaNjrgnLSgf4r: a total of 126,513

36000 incoming from3PGPCbniF94Sg9tTUnoP7P5ZKV38WiuSKDU, last outgoing tx March, 9th (4kKM1NR6q7srhhUwBtNKYkxTB4wboa7ykf5xjPFkDRYw)

35000 incoming from3PBedPmp8fCJRWneWErsWdquPxuxkF2UAAq, last outgoing tx March, 3rd (HSLq37PU3S14V2AWBKkAyneQSkC2QEaXn18Nb4CBD1gH)

32500 incoming from3P3CGG6DNKpCsVtQatejFPRpBvPvRsHxFoe, last outgoing tx Feb, 28th (2xg16xUNegzm3BZtU98CspCb1NNPcBq8h2XqatCepN4q)

23013 incoming from3PGBm6ZcJ44kT2gUtDp98geGKZeNh98dC9B, last outgoing tx Jan, 1st (FX6NCnQQYwB33WQeGde4D38MHWGcmb7HUPYz36aueKG1)

I’ve only checked the nodes with the most ‘drawdown’ if WEP-6 were activated. It appears that at least half of the total amount of stale leases were sent from the active addresses.

I can see that the miners with smaller share of stale leases wil benefit from cancellation if the original lessors will either lease to their nodes or not update their leases at all, but if most senders wil just re-lease to the same nodes, not much will change.

Thanks, @phearnot for taking our proposal too seriously! Yes, there will be not many changes for active one nodes, but our main idea is to prevent stakers from nodes who decide to go in shadows (stop doing payouts and taking all generated rewards for own + don’t vote for protocol changes, etc…) Sadly current protocol there is no way to punish these people and the trust that we build in our staker is being ruined because of these people. That’s why we think this will be a fair way for both sides - if you are an active node/staker, no problem, but if not you can only cheat 1 year, then rip  . Let’s vote for it

. Let’s vote for it

A suggestion that can be very convenient for both investors and nodes for the vitality of the network.

The problem I see is that this proposal will not work properly for dApp-based leasing, because ussually it cancel lease and make a new lease for the whole stake in one tx. The good example is sWaves, if a seed phrase of wallet with sWaves is lost, so means the original waves will stuck on node forever.