Website | Twitter | Facebook | Youtube | Telegram | News | Reddit | LinkedIn

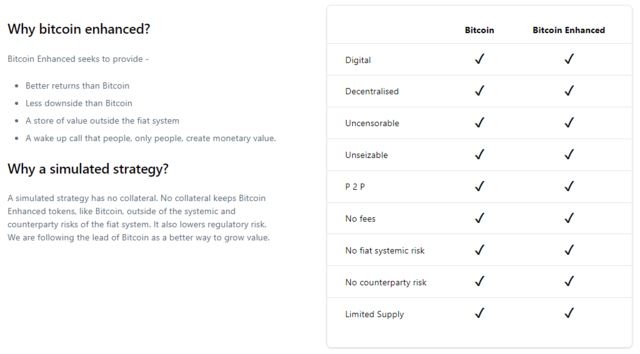

Diversify outside of the risks of the financial system with two blockchain tokens tracking a simulated long/short Bitcoin strategy!

Co-Founder

Branton Kenton-Dau, Director at Forecast Services Limited

Even if you are a seasoned financial expert I encourage you to learn more about the extraordinary human creation called money. Only people, not banks or governments can give money its value. This understanding, exemplified by Bitcoin is empowering. Bitcoin Enhanced tokens are no different. You the token holder, not us as the issuer give the product its value.

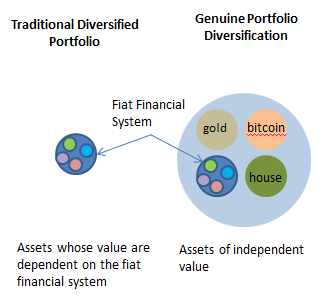

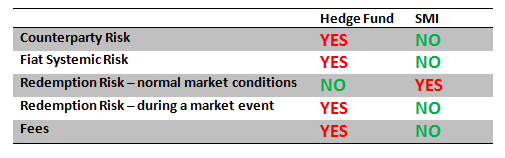

People can also maintain a financial product pegged to a specific value. They gave gold its stability for thousands of years simply because they needed a stable means of exchange. In the same way, token holders are expected to keep the value of CBE and XBE tokens pegged to the Target Price of the simulated strategy. Financial products created in this way have a different risk profile than collateralized methods such as hedge funds or ETFs. This different approach allows a return to portfolio diversification, the bedrock of sound investing.

I personally recommend the books and blog of Nathan Lewis. In Gold the Final Standard Nathan provides a jargon-free history of money and how stable money has worked for centuries.

The blockchain gives us a tool to do more with finance than ever before. I believe it will spawn an increasing number of Self-Managed Investments (SMIs) that will reduce the risk of investing.

Independent Advisor

Dr. Nathan Berg, Economist - Founding Advisory Board Member

Nathan Berg is Associate Professor of economics at University of Otago and Conjoint Professor at the University of Newcastle. Berg publishes in the fields of behavioral economics, financial economics, psychology and economics, and public policy, appearing in Journal of Economic Behavior and Organization, Psychological Review, Social Choice and Welfare, and Contemporary Economic Policy. Berg was a Fulbright Scholar in 2003 and Visiting Research Scientist at the Max Planck Institute-Berlin in the 2000s. He was a Visiting Foreign Scholar at the University of Osaka in 2008 and 2009, and the University of Tokyo in 2016 and 2018. His research has been cited in Financial Times, Business Week, Canada’s National Post, The Village Voice, The Advocate, Science News, Slate, and the Atlantic Monthly. He was awarded a Ph.D. (with honors) in economics and MA (with honors) in mathematics from the University of Kansas in 2001.

Roadmap

In Ourselves We Trust

Bitcoin Enhanced tokens represent a return to the basic principles of sound investing, not just with the natural harmony of the Phi Algorithm but in the way they operate. They are examples of Self-Managed Investments (SMIs):

-

Like Bitcoin and the US dollar, token holders give CBE and XBE tokens their value. Learn more.

-

In the same way, people kept the value of gold stable for thousands of years token holders keep the value of CBE and XBE (when XBE reaches the Target Price) pegged to the Target Price of the simulated Bitcoin strategy.

The result is:

- The value of tokens is not dependent upon any external authority, including us the issuer.

- Token value is independent of what happens in the fiat financial system enabling a return to portfolio diversification.

- Tokens and their value reside solely on the decentralized blockchain keeping them secure and away from external interference.

- People with the most vested interest in XBE and CBE, token holders themselves, are the ones responsible for maintaining their peg to the Target price.

Compare this with a digital currency like Tether where the value of the coin depends upon redemptions into US dollars. Redemptions require the effective functioning of both the Tether company and its bankers. If Tether’s dollar assets become unavailable because of fraud, bank failure or seizure by regulators, the value of Tether’s coins could fall to zero.

Only buy Bitcoin Enhanced tokens if you are willing to trade them at the Target Price. (Applies to XBE tokens once they reach the Target Price.) It is your responsibility.